Coffee Shop Predictions for 2024

2024 is already well underway, and we’ve recently been thinking about the changes that may be coming to the UK coffee shop market over the next 12 months.

The hospitality industry as a whole continues to see the impacts of a number of global crises. Combining this with rising costs of coffee and labour, increased awareness on the impact of caffeine on health, and businesses struggling with falling demand, staff retention and increasing costs, coffee shops have no shortage of things to keep their eye on in 2024.

In this article, we’re laying out a number of coffee shop predictions that we’re forecasting for the year ahead, and their potential impacts on the UK coffee market for 2024.

Rising Prices to the Coffee Consumer

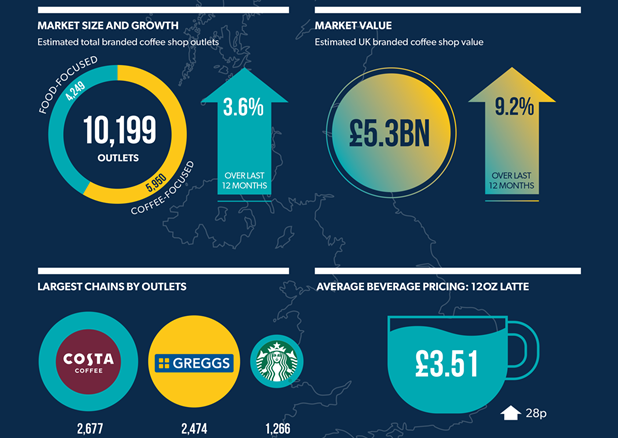

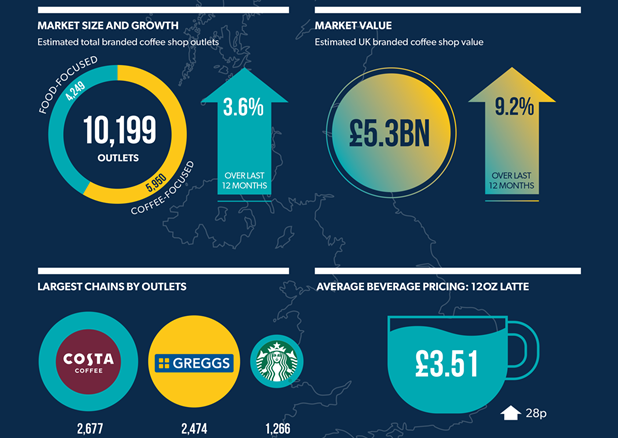

According to the Project Café UK 2024 report which assesses the UK market through online surveys, consultations and in-depth interviews, the average UK price of a 12oz latte has risen by to £3.51, up 28 pence from last year.

Hidden behind that latte are a many number of costs to the coffee shop, including the price of the raw ingredients (milk and coffee), the cost of rent, labour costs, energy bills, and tax. Of that £3.51 for a 12oz latte, 20% is immediately taken off as VAT. The coffee shop now has £2.80 to divide up between staff costs, rent, energy, and cost of ingredients, with hopefully a little left over for profit.

In 2024, global conflicts continue to escalate. Prices for coffee beans continue to rise, inflation has made skilled labour both more expensive and harder to retain, along with subsequent rises in rent and reduced consumer demand, and energy costs continue to rise thanks to a number of political conflicts. It would be foolish, then, to bet on anything other than continued rising prices in coffee shops for the average consumer.

If we had to guess, standard prices for an average cup of coffee will be higher this time next year, and consumers may look for cheaper alternatives to their favourite cup of coffee. This could look like a preference shift towards smaller sizes, a reduction in demand for optional extras e.g. syrups, and a reduced consumption in general favouring a cup of coffee at home.

Embracing Automation

Just a few weeks ago, the Specialty Coffee Association announced the first sponsorship by an Automatic ‘bean-to-cup’ coffee machine, in a three year deal between Thermoplan and the World Latte Art Championships 2024-2027.

The SCA’s announcement that baristas will be using a Black&White4 CTS in competition for the next three years received its fair share of backlash across social media, with Instagram comments being disabled from the announcement post. Though the announcement sparked plenty of debate and criticism around the ‘dying art’ of coffee service, there is no doubt that the move is reflective of the growing interest for automatic machines within the UK coffee market.

With continued rises in the cost of skilled labour, and increasing availability and improvements in the technologies of automatic coffee machines, we’re predicting a continued rise in automation within the UK coffee shop markets. This may manifest as an increase in the use of automation within the barista’s workflow to improve the base line standard, such as automatic tampers, grind-by-weight espresso grinders and small electric batch brewers, along with automatic machines capable of partially replacing the barista.

We’re noticing increasing demand for bean-to-cup machines from the likes of Schaerer and Eversys as preferences continue to shift towards automation, with many businesses struggling to pay for and retain well-trained baristas. Specifically within the super-automatic category of espresso machines including Eversys, amongst others, we’re seeing cup quality that can rival and even outshine the average barista when it comes to consistency, taste and speed.

Though the cost of these machines is still above that of traditional espresso setups, the large reduction in labour costs and improvements in consistency are big wins for many in the UK coffee industry.

Expanding Service Offerings Beyond Coffee

“Wow, but they were so popular?”

“Shame, they’ve been around for years.”

“I guess they just couldn’t keep it going any longer”.

We’ve all heard some iteration of the above about an independent local business over the last few years. With the issues stated above causing rising costs, even the best coffee shops can no longer survive just by being a great coffee shop.

Many cafés are now expanding their service offerings in order to pay the bills, and we’re expecting this to continue into 2024. As consumers become increasingly more price conscious, demand is falling for coffee outside of the home. Cafés will therefore be looking to increase footfall through other means; expanding their menu by offering hot and cold food options, dinner service and alcohol, along with live events and gigs, guest pop-ups and kitchen takeovers.

It’s becoming less and less viable to exist purely as a coffee shop, and businesses must now look to additional revenue streams in order to attract footfall, increase spend, and avoid closure.

Rising Demand for Decaf

The effects of caffeine on sleep quality and health has become more of a mainstream topic in recent years. Though coffee has been shown to have positive health impacts, so too has a good night’s sleep. With a half-life of up to 5 hours, caffeine later in the day can have significant impacts on sleep quality and health outcomes for many.

And it’s not just an increasing awareness of the affects of caffeine. A strong interest in decaffeinated coffee, it’s qualities and the processes that go into removing the caffeine, has also been shown amongst viewers in specialty coffee social media circles. Just a few weeks ago in January 2024, YouTuber James Hoffmann amassed over 1 million views on his video aptly titled ‘Decaf Explained’.

In it, Hoffmann details the additional positive health affects of decaf coffee over regular coffee thanks to an increased concentration of polyphenols. The polyphenols found are said to have positive effects on gut health, in addition to the benefits of the fibre found naturally in a brewed cup of coffee.

As awareness increases, so too does demand. Coffee drinkers and consumers are increasingly going to look for more readily available and higher quality decaf options. Coffee shops, producers and roasters, will have to keep up. Increasing awareness on the effects of caffeine and the importance of sleep for a healthy lifestyle, combined with increasing investment into the quality and availability of decaf alternatives, demand for decaffeinated coffee is set to continue rising through 2024.