Leasing a coffee machine is a slightly complex process, especially compared to purchasing a coffee machine outright. A lease allows a business to spread the cost of their new coffee equipment over time, whilst protecting the equipment supplier from any risk by having the process funded by a lease provider.

There are a number of questions that often come up when businesses are looking to lease a machine, and not all businesses will be successful in their application. We’ve been supplying coffee equipment for nearly 40 years, and therefore have a pretty clear understanding on what a lease application involves, who is eligible and who is not, and when a lease is and isn’t the best option for our customers.

In this article, we’ll walk you through everything you could need to know about coffee equipment lease agreements.

Why would you Lease your Coffee Equipment?

The main draw for businesses that have decided to lease their new coffee equipment is to avoid the large upfront cost and to spread the payments over time, typically over a three to five year period.

Additional benefits can be found when working with a supplier that also offers coffee beans, equipment servicing and maintenance, and barista training, as the more things you package into the contract the more attractive the rates become.

Can Any Business Lease a Coffee Machine?

Any business is eligible to apply for a lease, but not all applications will be successful. A successful application requires passing a credit check conducted by the leasing provider. Businesses with a credit history shorter than 3 years are unlikely to pass, in our experience.

Whilst applying for a lease might sound daunting, there is very little you will actual need to do during the process on top of selecting your equipment, providing your details, and signing on the dotted line.

So, let’s walk through the coffee machine lease application process step-by-step.

How to Apply for a Lease on your Coffee Equipment

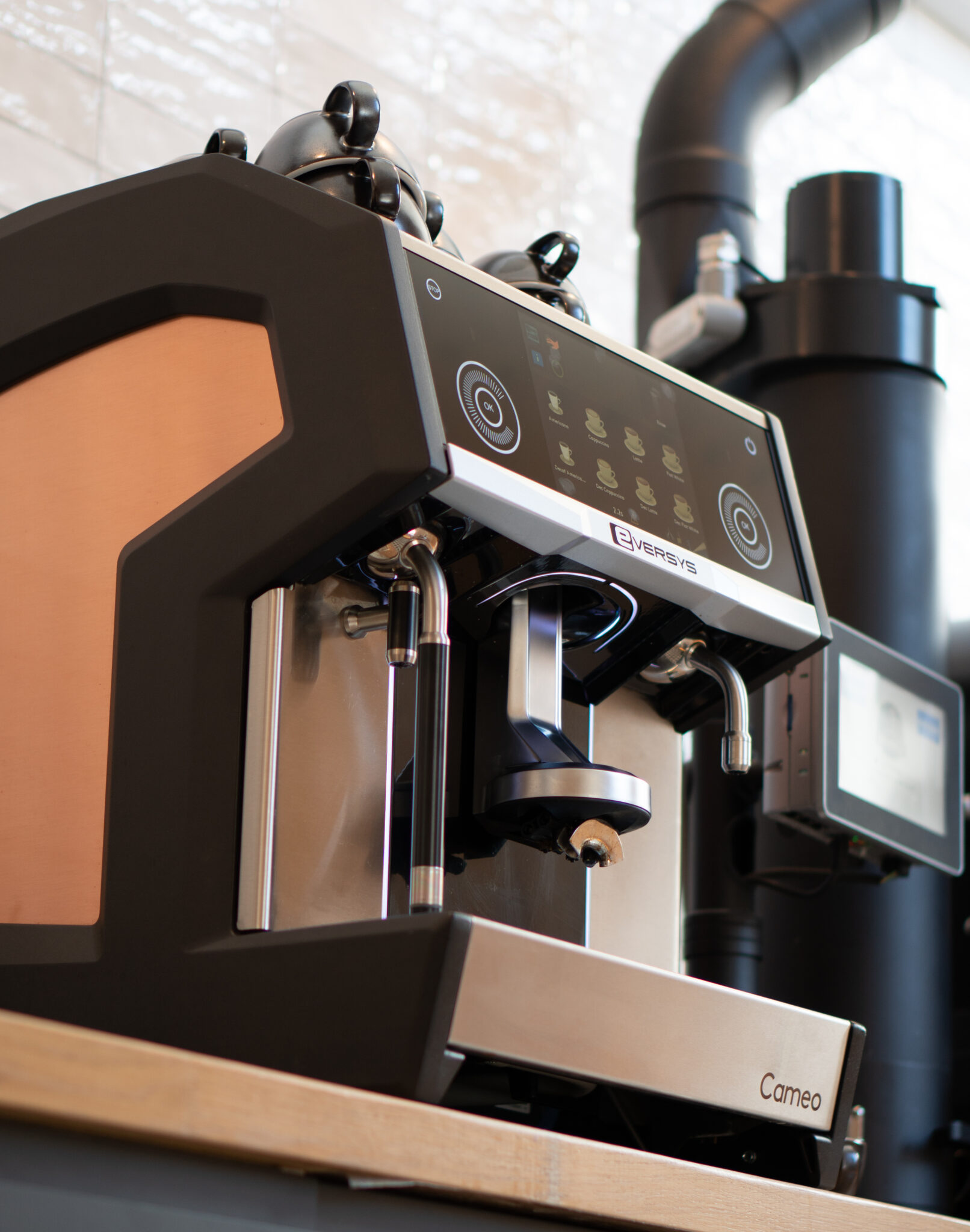

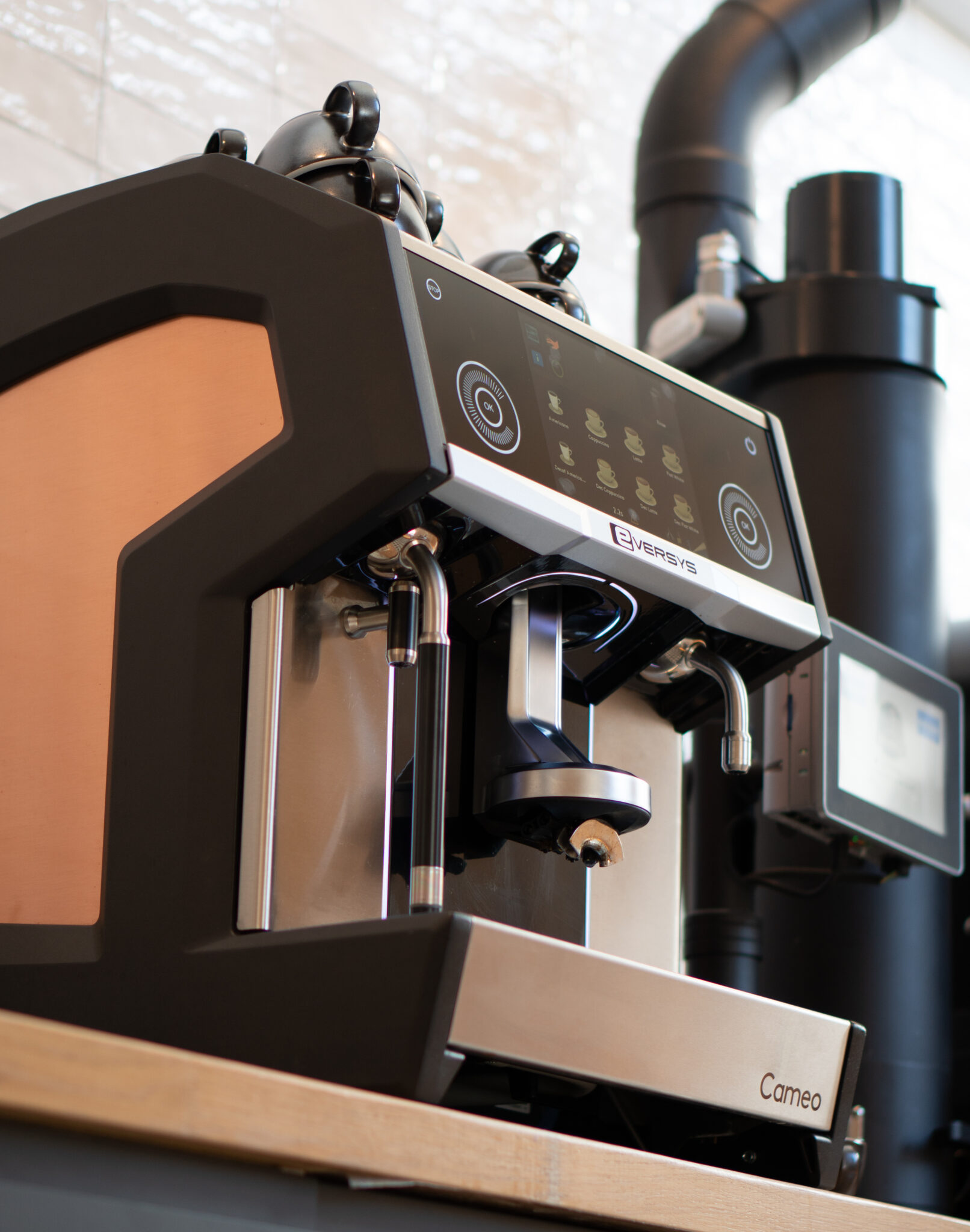

1. Decide on your equipment

Firstly, decide on the equipment that you’ll be leasing. It’s important to get the right balance between budget and requirements here, to avoid paying for features that will go unused or leasing a cheap machine that isn’t up to the task. The supplier should be willing to give you their unbiased recommendations in this regard.

2. Contact your equipment supplier for a quote

Once you have decided on the equipment, the supplier will then provide you with a quote which may contain a number of cost options. For example, we typically include three prices in our quotes based on an upfront purchase, a three-year, and a five-year lease repayment.

3. Decide on the length of your lease contract

Now you have been provided with a quote and potentially compared these with other equipment suppliers, the next step is to decide on the length of the lease contract, typically three or five years in length.

A shorter contract makes for higher regular payments but means you’ll be out of contract sooner, whereas a longer contract brings down the price of your regular payments but make for a slightly higher total cost given the longer length of the contract. Which time-frame you decide to go for depends on your businesses’ finances, and we would be happy to offer advice.

4. Confirm quote and provide your company details

Once the details have been ironed out, your next step is to let us know which quote you’re proceeding with and to provide us with your limited company registration number. This will let us perform a quick check on your business so that we can gauge your lease eligibility before continuing with the application.

5. Lease provider performs a credit check

Once we’re confident that you’re likely to pass the credit check, we’ll begin your application by passing on the details of the quote and your company registration number to our leasing provider, who then perform a credit check of your annual filed accounts history. The reason a third-party leasing provider funds the process it to protect the machine supplier from the financial risk, though this should come at no extra hassle to yourself.

How long the lease application process lasts depends on the size of the lease and the complexity of the credit check. Often the success or failure of the application can be discovered that same day for smaller quotes and when there are no complexities during the credit check. For larger lease applications of £250,000+ and more complex credit checks, a few weeks may be needed for the lease provider to gain internal approval and complete their due diligence.

6. Lease provider drafts contract documentation

Pending a successful application, we’ll input the financial details of the contract into the lease provider online portal which will then be used to draft the lease documents. The contract will be a binding agreement between yourself and the leasing provider and contains the terms and conditions, the install location of the equipment, the payment schedule and amounts, and the details of the direct debit.

7. Review the documents and sign the lease agreement

The lease contract will then be sent to you for signature, either electronically for an e-signature or as a hard copy. The documents will need to be signed by a director of your company as listed on Companies House, or a director must give written permission for any other person to sign.

8. Supplier schedules the installation and orders the equipment

Once we, the supplier, have been given signed documentation, the contract is now legally binding, and so we now have the go-ahead to place equipment orders and schedule the installation with our service team. Our turnaround time from signed contract to installed machines is typically two-six weeks, save for any irregular circumstances and equipment lead times.

9. Machines installed, Contract goes live

Once machines are inspected, tested, and installed, you’ll contribute quarterly (or monthly, if agreed) towards the cost of the machine via direct debit, as stated in the lease contract. If you’re also looking to include coffee beans, training or servicing in the package, we’ll also get your wholesale coffee account set up allowing you to place orders on our system.

10. Start serving great coffee

So, that’s the full run down of the application process for a lease contract when looking to purchase a coffee machine from a supplier like ourselves. Let’s quickly discuss what you can do if your application was unsuccessful.

Before you continue...

We're on a mission to educate businesses on all things wholesale coffee. If you're getting value from this article, consider subscribing to our fortnightly email newsletter.

My Application Wasn’t Successful, What Are My Options?

So, your application wasn’t successful and you’re unable to apply for a lease based on the information you’ve provided. We’ll always try and avoid this by letting you know if we think the application may be unsuccessful at the start of the process, but sometimes these things just happen.

The reason behind most lease application failures is down to the credit check, and the fact that the business must have been trading for at least three years for our leasing provider to approve the application. There is also the rare scenario in which you are already under a lease contract with the same provider, and your new application would go over the account limits that they have in place. But, typically, it’s the credit check that gets in the way.

Reapply with new details

The first thing to consider when an application fails or is likely to fail is if there are any other individuals who could sign the lease agreement. These will typically be people from companies that your business is tied to, shares directors with or has trusted business partners in. In this case, another company would be listed on the application and be subject to the credit check, but then the equipment location and direct debit details will be linked back to your business.

Consider the Alternatives to Leasing

Failing this, you will be required to consider purchasing the equipment. Whether with your own funds, with aid from an investor or from a personal bank loan, if you are unable to apply for a lease and the supplier does not offer rental agreements, you’ll have to figure out a way to buy the machine from the supplier. Watch this video which discusses the pros and cons of purchasing vs leasing your equipment.

You may want to speak to your supplier at this stage to see if there is room to reduce the spend through lower spec equipment and removing optional extras, or consider going with a cheaper supplier or searching for second-hand equipment.

It is quite rare that we’ll walk a new customer through this process and have them be unable to apply for a lease in one way or another. It’s more commonly seen with new start-ups and independent businesses, but rare nonetheless.

In the case where money is tight, you’re struggling to apply for a lease and cannot afford to purchase equipment from us, we may not be the best supplier for you. We’re proud to offer a premium service and so for those that are working to a tight budget, we may recommend researching our competitors or looking for used options.